UK gas and power market insight: The April 2021 Gas rose 12.3% to 48.39 p/therm last week as a shipping vessel ran aground in the Suez Canal causing major disruption and delays to LNG deliveries. Meanwhile, scheduled maintenance at UK and Norwegian gas production facilities reduced imports further. This disruption outweighed the effect of unseasonably warm European temperatures forecast for the start of April.

The April 2021 Power rose 4.8% to £57.21/MWh as wind generation remained low for the majority of last week increasing reliance on gas-fired power generation. This caused power to follow the gains in gas.

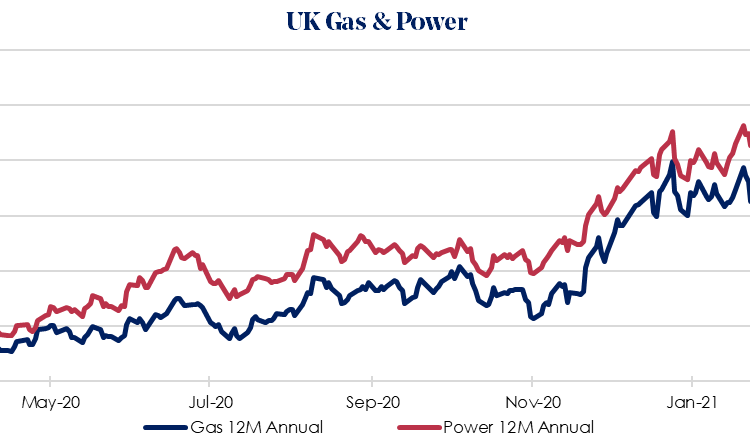

The April 2021 12 Month Gas price rose by 6.3% last week to 47.19p/therm with near term supply concerns caused by the Suez Canal disruption of LNG deliveries boosting Summer 21 prices. Some bearish pressure from a fall in carbon limited Winter 21/22 price gains.

European Gas storage remains at its lowest level for the past 3 years. However, despite the supply disruption, milder weather across Europe has caused a reduction in demand and led to some injection this week. UK Gas storage increased 2.8% and is now at 33.6%.

The April 2021 12 Month Power price rose by 3.0% to £60.52/MWh last week tracking the equivalent gas contract. Gains were weaker than for gas as a strong renewable outlook for the start of this week provided some resistance for near term power prices. Winter 21/22 price gains were also limited by a fall in carbon.

Brent crude oil has seen very little movement over the last week, with a small price rise of 0.1% to $64.57/bbl. The lack of price movement is likely related to two counteracting factors. The first, weighing down on prices is the expansion of lockdown conditions across Europe, causing another wave of stifled production and economic activity. Counteractively, the recent blocking of the Suez Canal has somewhat reduced availability of supply shipments, supporting the price.

Pound Sterling saw a small fall last week of 0.6% to 1.3787. The ‘safe-haven’ US dollar has risen as concerns over an upcoming global surge in COVID-19 took hold. The Pound has however strengthened this week as 30 million Brits have received at least their first vaccination, serving as a ‘shot in the arm to Sterling’. The Pound has however suffered as relations between the UK and the EU remain frosty over vaccine exports. This is being seen by some as early signs of a more acrimonious Brexit than was originally hoped.

European carbon fell by 0.5% last week to €41.63/tCO2 as the EU energy markets slipped over concerns of the next wave of COVID-19. Much of the European mainland has now either increased the intensity or extended the duration of their lockdown measures, stifling energy demand and industrial production. Should lockdown measures continue to intensify it is likely EUA carbon prices will go on falling.

European coal prices rose by a further 1.5% last week largely related to the surge in the price of gas and LNG shipments, which have been stalled through the recent blockage of the Suez Canal. In lieu of gas as an alternative, and with EUA carbon prices having eased over the last couple of weeks the appeal of coal for power generation has increased. Should lockdown conditions intensify further, European demand for coal may drop, and the price with It.

Source: Beond Group