The European gas market remains on a knife edge as winter approaches. Four key factors are set to drive market dynamics across winter:

Russian gas flows

European gas storage levels

European gas demand

LNG imports.

Russian gas flows have limited flex to go lower following the shutdown of NordStream 1. EU Storage levels are now slightly above the 5 year range (as we looked at in a recent snapshot). Gas demand remains a key driver given uncertainty around gas demand reductions in response to both policy and pricing. The other key variable is LNG imports – this is what we focus on today.

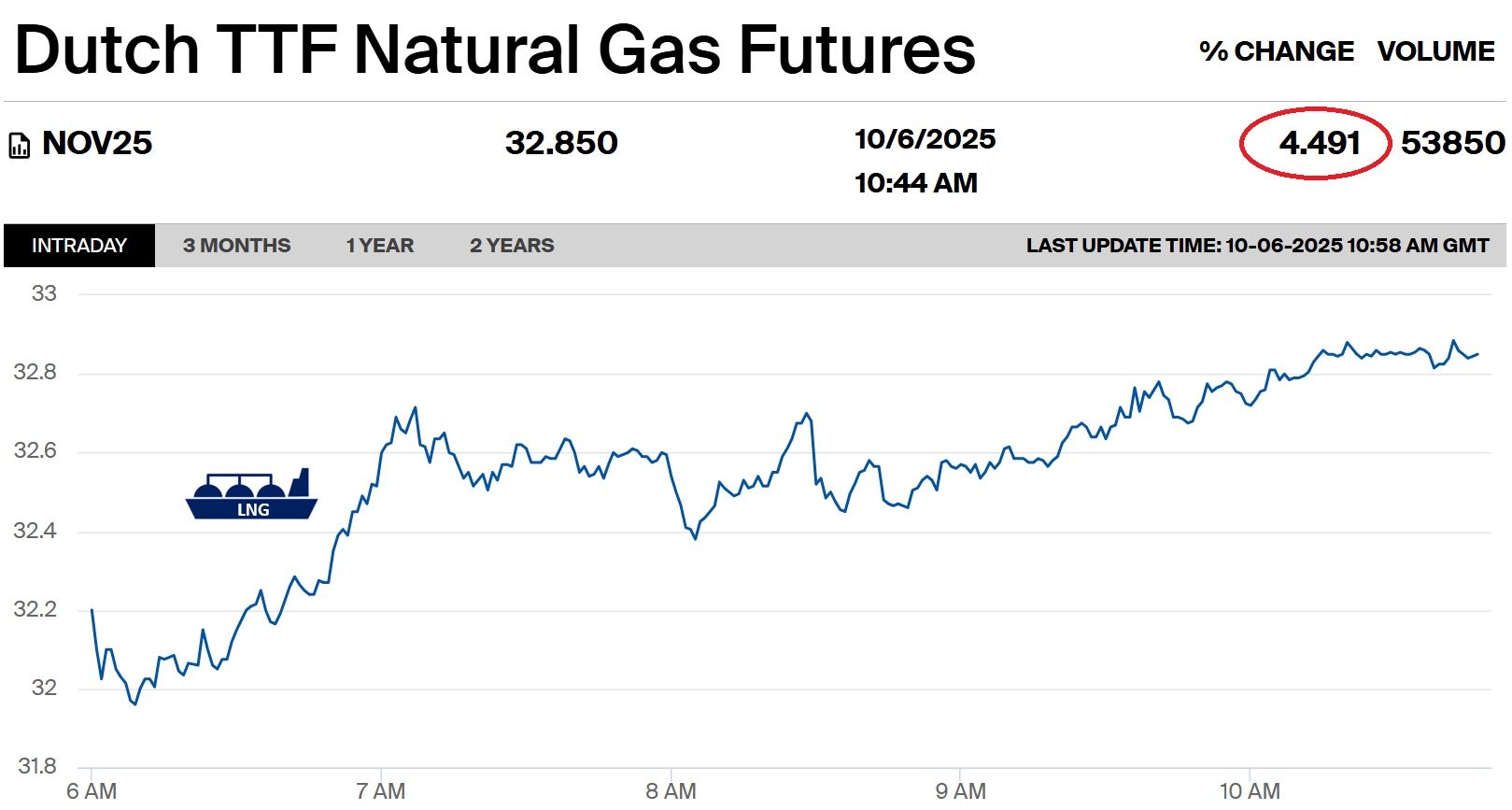

High European LNG imports continue

European LNG imports in August 2022 continued the upwards trend of historical monthly highs vs previous years (as seen in the left hand panel of Chart 1).

August saw an increase of 5.8 mt year on year (253 mcm/d higher year on year) to help balance lower Russian flows. Russian supply was 250 mcm/d lower in August (year on year) through the three traditional pipeline supply routes into Europe.

Higher LNG imports in 2022 have been enabled by significant demand destruction in other regional markets given extreme price levels. Asian imports were down 1.9 mt in August vs last year, while South American imports were down 1.6 mt.

Chart 1: European & Asian LNG imports

Source: LNG Unlimited, Timera Energy

Major regas constraints in Europe

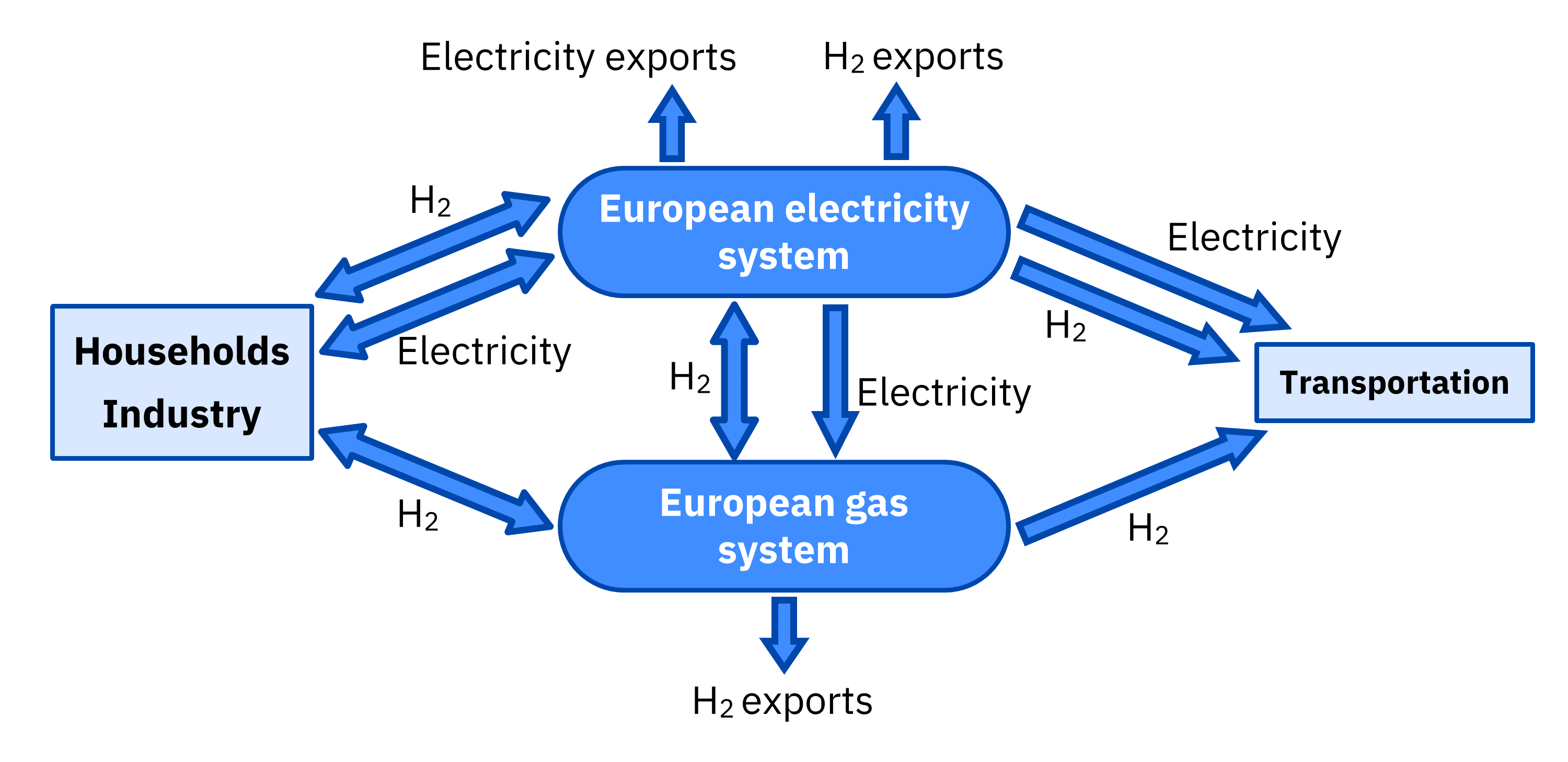

The main factor constraining higher European imports over the past few months has been infrastructure. This includes both regas & pipeline capacity constraints (e.g. constraining flows of gas out of Spain & the UK).

There is some good news on the regas front. The Floating Storage & Regas Unit (FSRU) at Eemshaven received its maiden cargo last week, with more FSRUs set to come online in Germany this winter. Chart 2 shows the incremental pipeline of confirmed & announced regas capacity additions in Europe.

Chart 2: European regas additions

Source: Timera Energy

Regas capacity does not guarantee incremental LNG supply (which depends on global supply and relative regional pricing). But it does start to address the severe constraints currently driving locational gas price divergence across Europe.

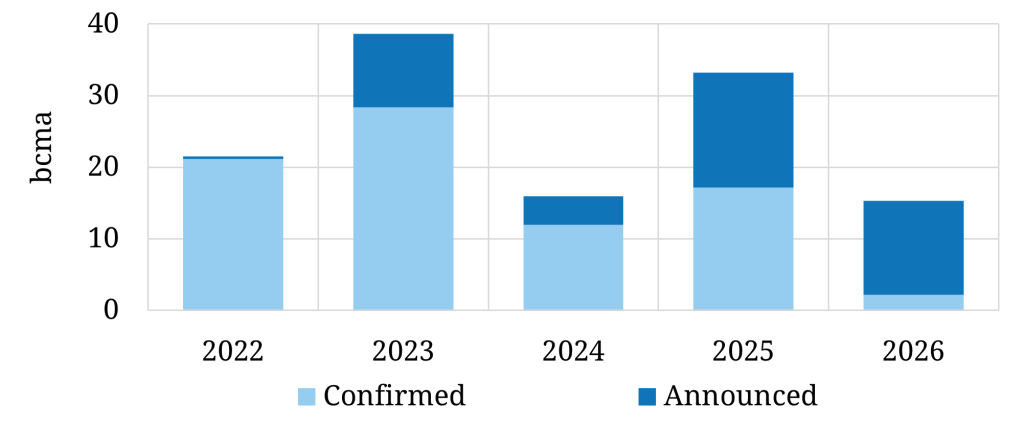

Price signals remain strained

Forward gas prices show that despite planned FSRUs, the market expects Europe to remain capacity constrained. Chart 3 shows the Spark NW Europe DES price (green line) at a substantial discount to TTF across 2023 (more than 10 $/mmbtu across winter).

UK NBP forward prices have a more pronounced seasonal shape than TTF. These are at a premium across winter as the UK fights for gas, before swinging to a discount next summer.

Chart 3: TTF vs NBP vs NW Europe DES

Source: CME, Spark Commodities, Timera Energy

The premium of European hub prices over other regions (e.g. Asian JKM) is signalling that European regas terminals will be operating at near maximum utilisation across the winter. Europe’s big risk remains a cold winter in NE Asia which would drive fierce competition for cargoes.

A cold winter could see large demand markets like China (LNG demand down 20% y-o-y in 2022) kick into action. Cargo competition could see LNG supply diverted from Europe and a renewed surge in prices.

The situation in European energy markets has started to improve across the last 3 weeks as (i) policy action has taken shape and (ii) increasing evidence of price induced demand response has emerged. Europe’s real risk is now adverse weather.

We will be discussing this and other key risks in more detail in our upcoming winter outlook.

Source: Timera Energy