As recently as mid-summer 2022, European gas market was mainly concerned about how to go through this winter with no major disruptions to the region’s supply/demand balance and to have underground facilities well-filled for summer 2023. As we are now in the midst of winter, the key preoccupation ironically seems to be that storages may enter the injection season at very high levels and without adequate response the continent will be moving towards oversupply over the next nine months or so.

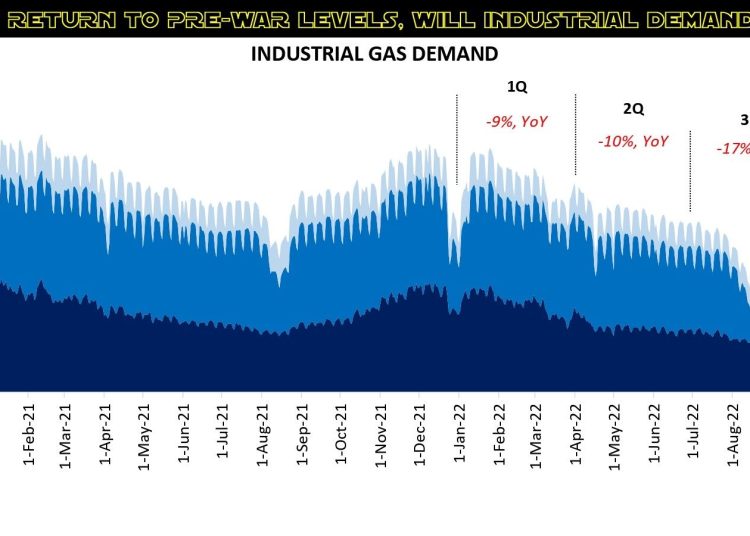

While the increase in supply to Europe was mainly provided by LNG last year, on the demand side it was industry that saw a real destruction to its gas consumption throughout 2022. The combination of both, together with favourable weather conditions, changes in consumer behaviour, maximized exports from Norway, etc., more than offset the decline in Russian pipeline flows. And with prices along the curve falling to where they stood before the war in Ukraine started, the revival of industrial gas demand looks like one of the key options to remove a potential surplus in Europe.

German, French, Spanish, Italian, Dutch, Belgian and British manufacturers, which collectively account for more than 70pc of gas demand across the continent, decreased consumption by approximately 20pc in 2022 compared with the five-year average. In 4Q alone, industrial gas consumption in these seven countries dropped more than 30pc, depriving the region of around 100 mcm/d.

But if it generally does not take too much time to stop production at an industrial site, bringing a plant back to full operations can be much more costly and time-consuming activity. If at all possible, given that some players do not have plans to reopen their industrial capacities in Europe and want to shift at least part of their operations to other locations.

The technological process in chemicals, metals, fertilizers, paper or construction has its own peculiarities which determines industries’ hedging strategies within their procurement policies. Given a large variety of price indices that gas purchases made by industrial players are linked to, making forecasts on industrial gas demand is actually a complex and far from trivial thing.

I think it would be really useful for everyone to hear more from people from within manufacturing sector – your views on the current European gas market, industrial gas demand prospects, exposure to price changes, etc. Comments are welcomed and appreciated, as always.

Source: Yakov Grabar (LinkedIn)