5 key takeaways from the just released IEA Gas 2021 report

- Gas demand growth is slowing down: largely driven by the Asia Pacific region and the industrial and power sectors, gas demand is expected to grow by 2.2% per year between 2020-24 (vs 3% between 2015-19). still stronger policies are needed to put it on track for net zero emissions;

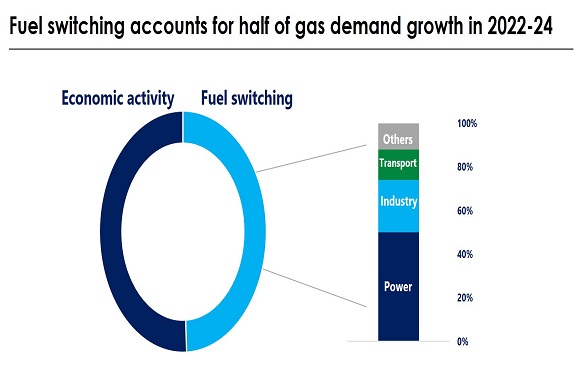

- Switch to gas from more polluting fossil fuels accounts for half of demand growth between 2022-24, contributing lower emissions across all sectors;

- Existing and under development fields meet the bulk of incremental supply, supported by the investments made before the covid crisis;

- All eyes on Asia: the Asia Pacific region accounts for almost 90% of gross LNG demand growth, driven by China, India and other emerging Asia where it facilitates the switch away from coal and oil;

- Green gases are taking off, while policies and industry initiatives to reduce the emission intensity of gas supply are shaping up -but definitely more effort is needed both from the consumers and producers side.

What is your view? How will global gas markets evolve? What are the main challenges and opportunities ahead the industry? What should be the focus of policy makers?

Source: Greg Molnar

See original post by Greg at LinkedIn.