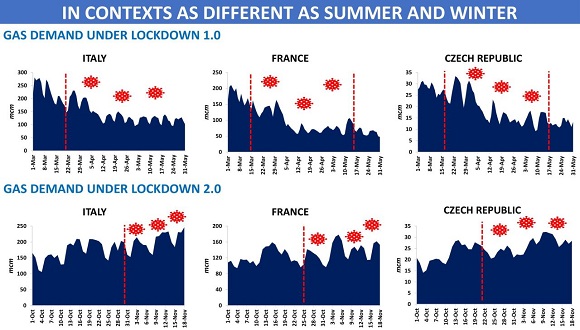

The saying that ‘lightning never strikes the same place twice’ perfectly describes the impact of new lockdown on European gas market vs. the effect previous restrictions had on demand dynamics. Despite the common source of concern, market conditions now and then are very different from one another.

For gas market, the specific nature of lockdown 2.0 is not that the anti-Covid measures adopted in late October are not as tough as half a year ago. Countries have chosen not to constrain manufacturing activities and keep schools open, which will help to avoid a drop in demand from the industrial sector and to maintain stable gas consumption for heating educational facilities.

The essential difference is that remote working during the winter, when residential gas demand peaks, should provide support to aggregate consumption. More people staying at home are likely to contribute to heating demand growth in addition to the seasonal rise in gas usage. Stricter regulation of hospitality industry can hardly outweigh a positive effect of locking people up.

However, the impact of distance working on gas consumption will depend critically on temperature conditions. This is also in sharp contrast with lockdown 1.0.

Source: Yakov Grabar

See original post by Yakov on LinkedIn.