PREMIUM CONTENT

European gas and power markets: supply and demand forecasts for 2024/25

Detailed presentation covering European gas and power markets. It covers key recent price drivers, gas supply and demand preview for summer 2024 & what to look out for in winter 2024/25.

Start with a FREE 30-day trial and then save up to 22% with an annual subscription. Get instant access to over 2,000 reports. Cancel anytime.

FREE TRIAL

Already a subscriber ? Log in

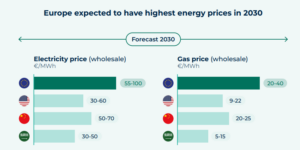

Competitiveness of European energy-intensive industries

Deindustrialisation of Europe has already started. The number of EU firms in the Fortune Global 500 has shrunk and labour productivity growth has also declined significantly. Sectors including aluminium, refining, steel, and ammonia have already started deindustrialising: Europe’s share of worldwide aluminium production fell from 30% in 2000 to 5% in 2022, while the EU has lost 2/3 of its primary aluminium production since 2008. Moreover, 70% of ammonia production capacity was curtailed during the peak energy prices in 2022.

Start with a FREE 30-day trial and then save up to 22% with an annual subscription. Get instant access to over 2,000 reports. Cancel anytime.

FREE TRIAL

Already a subscriber ? Log in

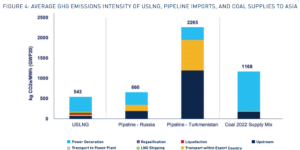

U.S. LNG cleaner than some European gas pipeline imports?

The results of this study indicate that the average GHG emissions intensity of pipeline gas in Europe was about three-quarters of US LNG for gas coming from Norway but more than a third higher than USLNG for gas coming from Russia. They also conclude that coal was over twice as high as US LNG in both Europe and Asia. This study provides an integrated analysis of CH4 and CO2 emissions across leading fuel supply chains (US LNG, Pipeline Gas, Coal), using the latest available data from reputable sources among government agencies and multilateral organizations, in a detailed methodology designed to […]

Start with a FREE 30-day trial and then save up to 22% with an annual subscription. Get instant access to over 2,000 reports. Cancel anytime.

FREE TRIAL

Already a subscriber ? Log in

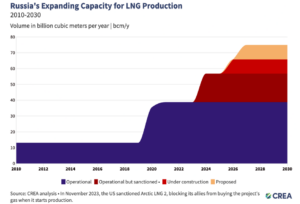

Stalemate on Europe’s imports of Russian LNG

For the past two years, there have been unsuccessful attempts to push politicians to ban Russian LNG imports. The situation has hit a stalemate, with importing Member States willing to reject Russian gas if EU-wide sanctions are applied, overruling concerns about potential gas shortages. A Russian LNG price cap policy could slash export earnings 60% on 2023 levels and leverages Russia’s huge reliance on Western owned or insured LNG tankers to force down the price of its gas exports.

Start with a FREE 30-day trial and then save up to 22% with an annual subscription. Get instant access to over 2,000 reports. Cancel anytime.

FREE TRIAL

Already a subscriber ? Log in

INFRASTRUCTURE

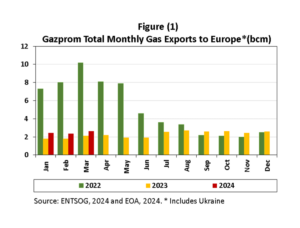

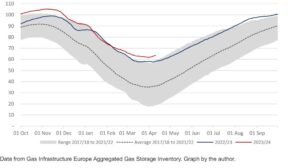

European gas withdrawal at almost record low levels

Between November 1st and March 31st, the winter of 2023/24 saw a net withdrawal of 44.0 billion cubic meters. This...

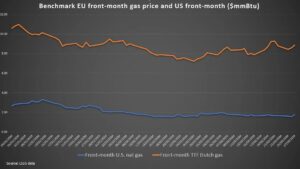

European gas: is the problem solved?

Mild weather, ample natural gas imports and healthy gas stockpiles kept European gas prices in check in March. The EU...

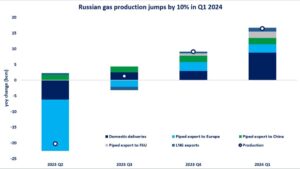

The future of Russian gas in Europe

The European Union has committed to phasing out all imports of fossil fuels from Russia by 2027. While sanctions have...

European gas market reports, presentations & analysis.

Natural gas market intelligence delivered to your inbox every Tuesday!

By signing up, I agree to our TOS and Privacy Policy.

FREE 30-DAY TRIAL

Start with a FREE 30-day trial and then save up to 22% with an annual subscription. Get instant access to over 2,000 reports. Cancel anytime.

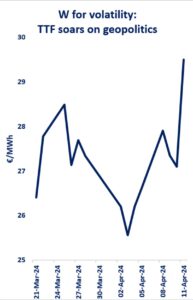

GAS PRICES

TTF price soars by almost 10% to near €30/MWh

Will European gas prices fall in the future?

RUSSIA

Ukraine will not negotiate gas deal with Russia