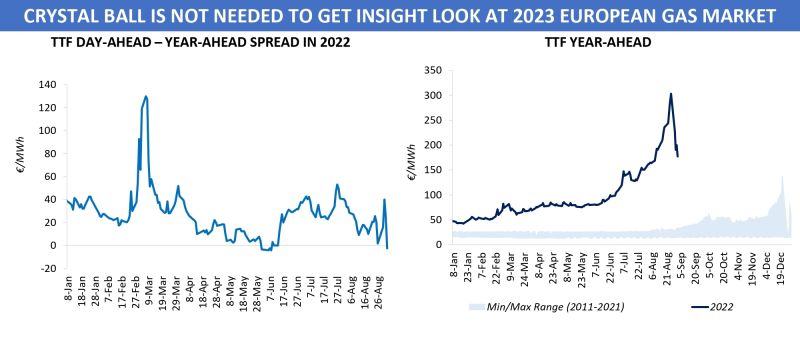

This week, prompt contracts at key European gas hubs lost about 40pc in value. This substantial price decline, however, should not mislead anyone, since the TTF Day-Ahead is still more than eight times above the 2011-21 average. Further out on the curve products, among which is the Calendar 2023, are no different.

The Front-Year contract closed higher than the Day-Ahead on Friday, for the first time since the very beginning of June 2022. This was largely caused by higher volatility on the front end of curve in late August – early September, but instead of searching for reasons that can explain the fall in near-curve contracts it is much more important to shift focus onto the 2023 products.

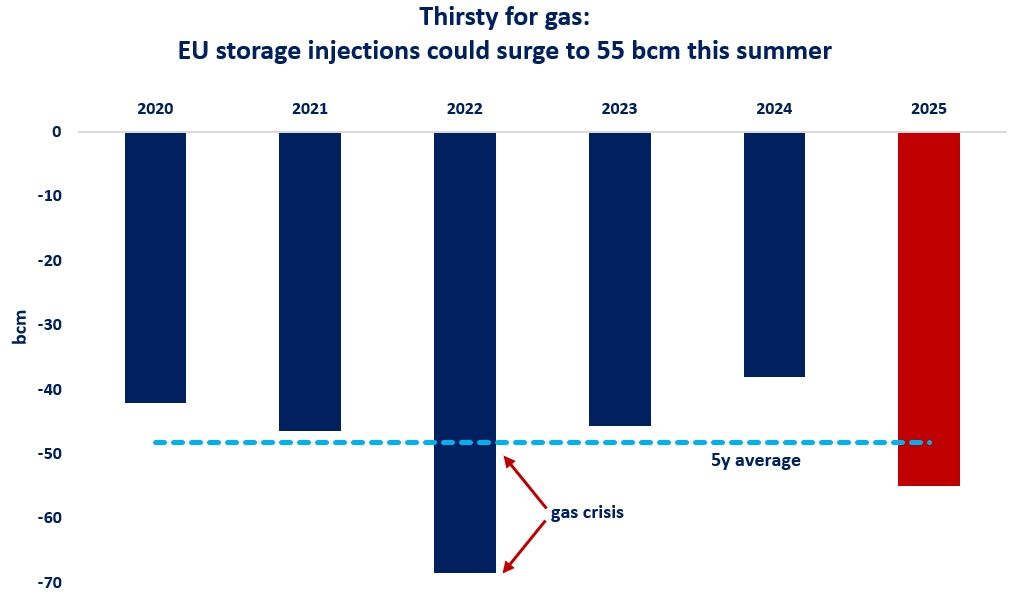

While the TTF prompt prices declined by approximately 10pc over the last month, the Front-Year contract, in contrast, rose by the same amount between 1 August and 2 September 2022. Fundamentally, the rise in curve products can be perfectly well understood. After all, even if the coming winter months will be warm enough, shippers should inject significant, if not record, amount of gas into the underground storages during summer 2023. Otherwise, the 2023-24 heating season risks becoming incomparably more serious test for the continent’s energy system than the next six months.

The European natural gas market has found itself in a situation where both winter and summer ‘components’ provide strong support to the Front-Year contract. At the same time, as winter approaches, players’ concerns over supply/demand fundamentals are gradually moving forward along the curve – away from the 2022-23 winter period towards summer 2023.

It is becoming increasingly clear that, given strong injection rates throughout the whole summer period of 2022 and with industrial gas consumption falling to multi-year lows, market participants will somehow manage to get through this winter.

But there is much less certainty about how things will unfold during the injection season of 2023. Nothing surprising about that: players will have much less room for reducing gas demand further and it is hardly possible to predict developments on the supply side.

Source: Yakov Grabar (LinkedIn)