European gas market is now in a period of change that has affected even things that had seemed unchangeable until recently. In the middle of 2021, who could have thought Russian gas flows entering Italy through Austria would be lower than imports from NWE, even if only for a short time? But that is exactly what happens now.

Gas flows at the Tarvisio entry point has averaged just over 45 mcm/d so far in 2022, which represents a decrease of about 25 mcm/d compared with the first five months of last year.

With prompt contracts trading at a considerable discount to front-month index deliveries in the second half of May, imports through the point declined further to 35 mcm/d in the last two weeks.

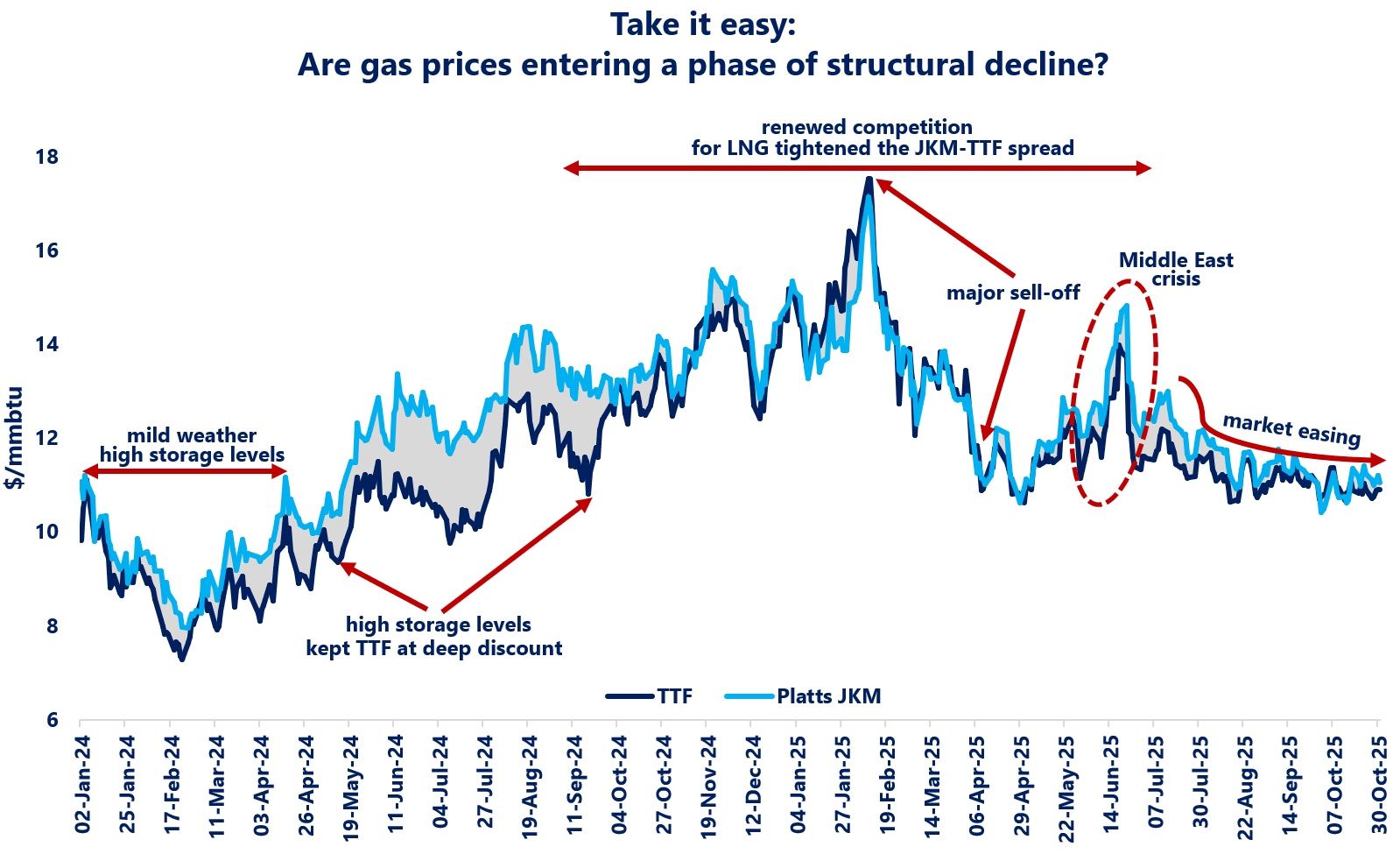

Amid this year’s drop in Russian flows, PSV prompt prices soared against NWE market areas in 2022. Between January and May, the day-ahead contract at the Italian hub was assessed on average at a €3.3/MWh premium to its TTF counterpart, a YoY increase of about four times.

This resulted in bringing back to life flows at the Passo Gries entry point.

If players resorted to imports from NWE only sporadically over the course of 2021, this year Passo Gries has turned into a sort of baseload supply route to Italy, speaking the language of power market.

Which should come as no surprise, since there is hardly any possibility for Italian importers to substantially increase inflows from other sources of pipeline gas. Flows from Algeria and via the TAP have already been maximized since the year start.

At the same time, Italy’s gas imports may soon return to a more typical breakdown by supply sources.

Low levels of gas stored at the country´s underground facilities (49pc on 28 May 2022 vs. 57pc on the same date in 2013-2021) will likely contribute to stronger demand for Russian volumes.

Wider spreads between contracts for delivery later in the summer and prompt products should encourage market participants to accelerate injections into the Italian storages.

Source: Yakov Grabar (LinkedIn)