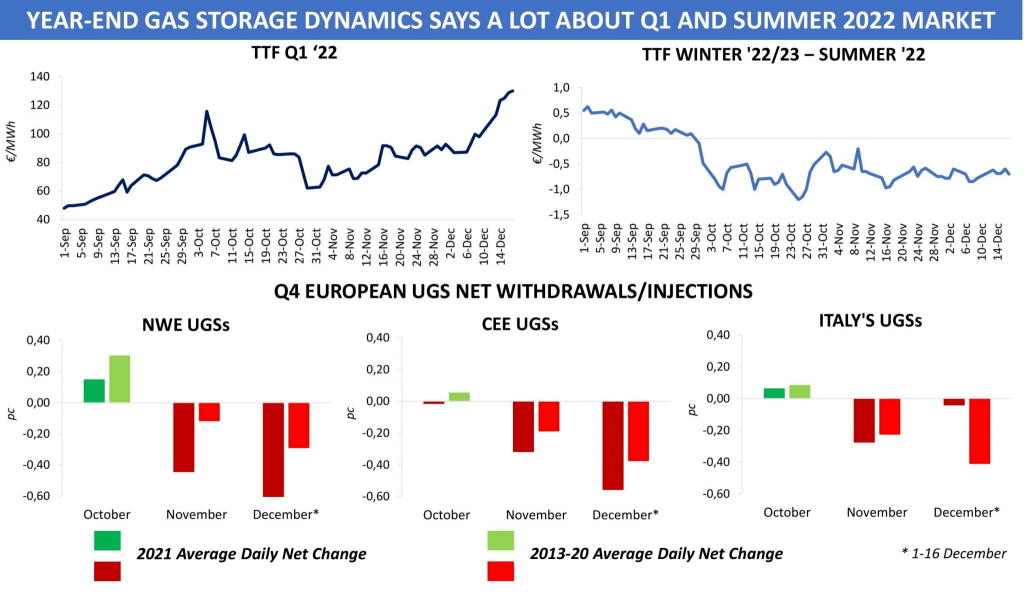

Low stocks of gas in storage have by and large shaped the context in which European market developed for most of the year. In some periods, there were other things that attracted greater attention from players but if you try to choose the 2021 word of the year in the region’s gas market, it will become apparent that ‘lower-than-normal inventories’ was a particularly distinctive term.

After a break of several months, low European UGS levels now again dominates the market agenda. This is partly because of seasonally stronger demand as compared to September and October, which act as ‘shoulder months’ when less energy is used for cooling and heating. But more importantly, the way storage situation unfolds in the final part of a year provides an understanding of the environment market participants will operate in both during Q1 and further in the summer season.

This winter, most shippers withdrew volumes from the region’s gas storages much faster than in the previous years. Between 1 and 16 December, the occupancy rates of the NWE and CEE underground facilities decreased by on average 0.68 and 0.56 percentage points per day, compared with 0.29 and 0.37 percentage points per day over the same period in 2013-2020. Withdrawals from the Italian sites slowed this month, but the country’s storage levels are still at multi-year lows for the time of the year.

Since early November, net withdrawals from the European UGSs amounted to approximately 18 bcm of gas, although the coldest months are yet to come. Players understand that very well, as evidenced by this week’s rise in winter contract prices to new record highs. Any prolonged cold spell in Europe, or in Asia-Pacific, will put much more pressure on the region’s storages, adding to uncertainty over Q1 supply/demand balance.

Market participants are no less concerned about what levels European storages will be at when summer 2022 arrives, thereby giving them a better understanding of the volumes to inject during Q2 and Q3. The spread between Winter 2022-23 and Summer 2022, which has remained in negative territory for the last two and a half months, is possibly the best indicator of players’ expectations for that period.

By the start of 2022, gas storages across the continent will likely stand at around 50pc full. Just to compare: European sites were on average 80pc full as at 31 December, in the period between 2016 and 2020.

Source: Yakov Grabar (LinkedIn)